It is not uncommon that both husband and wife work among couples of world talents in Japan. A typical case is that a husband works on full time basis and a wife does on part time basis (up to 28 hours a week). Even a wife, working on part time basis, has to enroll Japan’s social security schemes (health insurance, pension) and to pay premium by herself when she earns more than a threshold amount. Amount of the premium to social insurance can be however deducted from income before tax and be compensated partly by reduction of income and residential tax. This is called as “tax deduction for social insurance premium”.

In case spouse’s annual income and status of spouse’s employer fall into the Case E below, spouse’s premium to social insurance can be deducted from income of a main household for larger tax deduction. Should your family case be applicable, I recommend to read the rest of this article. Even if not, you understand better how the tax deduction for social security insurance premium works by reading the rest of this article.

- Case E: Spouse’s annual salary is more than JPY 1.06 M or 1.30 M AND Spouse or its employer does not enroll Employee Pension nor health insurance union so that Spouse enrolls National Pension and National Health Insurance by itself.

This article covers overview of tax deduction for social insurance premium. For details please contact HR department of your employer, a national tax office nearby or a tax accountant.

- Tax Deduction: Framework

- Tax Deduction – Social Insurance: Cases

- Tax Deduction – Social Insurance: Alternates for Spouse’s Premium

- Tax Deduction – Social Insurance: How to Apply

- Tax Deduction – Contacts and References

Tax Deduction: Framework

This section describes how income fax is calculated. “Income” in this article means total amount of annual income.

- Income = Revenue – Expense

- Income Tax = ( Income – Deductions ) x Tax Ratio

- Tax Ratio: See below

Income Tax Deductions

Various spends are allowed to be deducted from income, before income tax is imposed upon. Such spends include the following. Social insurance premium is among such expenses deductible from income before tax.

- Medical Expenses, Social Insurance Premium, Premium for life and earthquake insurance, Donations, Spouse deduction, Dependent deduction, Basic deduction

Applicable spends like the above are deducted from your income. The result becomes your taxable income, ( Income – Deductions ), which is used for calculating income tax.

Social Insurance Premium as Tax Deductible Spend

As you see above, an entire annual spending for social insurance premium (public pensions and public health insurance) is among those deductible from income.

- Income Tax = ( Income – Social Insurance Premium) x Tax Ratio

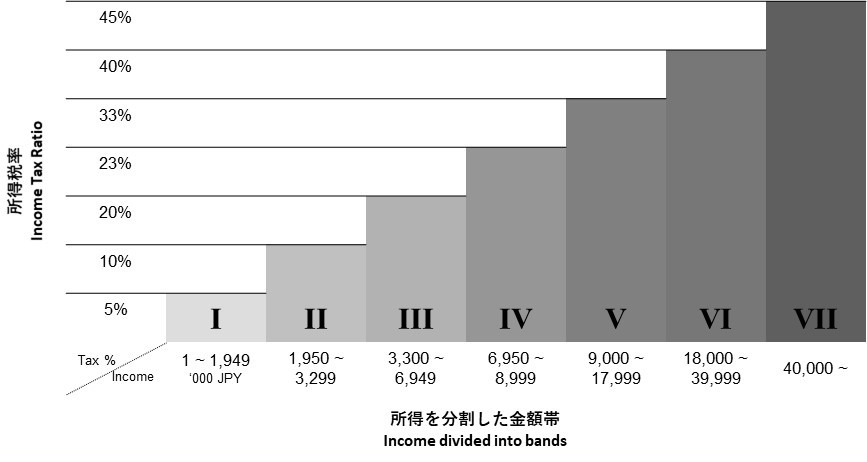

Income Tax Calculation: Tax Ratio and Adjustment Amount for Simpler Calculation

Income tax is calculated as follows:

- Income is rounded down to the nearest 1,000.

- The rounded income is divided into bands.

- Each band has its own tax ratio.

- Tax amount for a band is calculated as the product of income amount and tax ratio for the band.

- Total tax amount for an entire income is calculated as the sum of he tax amounts for the bands.

The bands and tax ratios are defined as follows (as of Dec 2020).

- From 1,000 up to 1,949,000 JPY

- Tax ratio 5% (Adjustment Amount 1D = 0 JPY)

- From 1,950,000 up to 3,299,000 JPY

- Tax ratio 10% (Adjustment Amount 2D = 97,500 JPY)

- From 3,300,000 up to 6,949,000 JPY

- Tax ratio 20% (Adjustment Amount 3D = 427,500 JPY)

- From 6,950,000 up to 8,999,000 JPY

- Tax ratio 23% (Adjustment Amount 4D = 636,000 JPY)

- From 9,000,000 up to 17,999,000 JPY

- Tax ratio 33% (Adjustment Amount 5D = 1,536,000 JPY)

- From 18,000,000 up to 39,999,000 JPY

- Tax ratio 40% (Adjustment Amount 6D = 2,960,000 JPY)

- From 40,000,000 and above

- Tax ratio 45% (Adjustment Amount 7D = 4,796,000 JPY)

Income Tax Calculation: Principle

Case study: Tax for annual income of 5 million JPY is in principle calculated as follows:

- Income of 5 M JPY is divided into the bands as follows: 5,000,000 = 1,950,000 + 1,350,000 + 1,700,000.

- 1,950,000 JPY = Portion up to 1,950,000 JPY

- 1,350,000 JPY = Portion from 1,950,000 to 3,3000,000 JPY

- 1,700,000 JPY = Portion from 3,300,000 to 5,000,000 JPY

- Tax amount for each band is a product of income amount and tax ratio for each band,

- 97,500 JPY = 1,950,000 JPY x 5%

- 135,000 JPY = 1,350,000 JPY x 10%

- 340,000 JPY = 1,700,000 JPY x 20%

- Total tax amount is a sum of the tax amounts of all three bands,

- 572,500 JPY = 97,000 + 135,000 + 340,000

Income Tax Calculation: Simplified

The method described above is the principle way of income tax calculation. It however takes time due to the division into the bands. There is a simplified way as well, which uses adjustment amount for simplified calculation (or “Adjustment Amount” in short).

Case study: Tax for annual income of 5 million JPY is in principle calculated as follows:

- Identify a band that your income maps to:

- 5 M JPY maps to the band III.

- Calculate tentative tax amount as a product of your income and tax ratio of the band:

- The tentative tax amount is calculated as follows using the tax ratio of the band III:

- 1,000,000 JPY = 5,000,000 JPY x 20%

- Adjust the tentative tax amount to a real tax amount by subtracting the Adjustment Amount of the band (3D):

- 572,500 JPY = 5,000,000 JPY x 20% − 427,500 JPY

- = 1,000,000 JPY − 427,500 JPY

Tax Deduction – Social Insurance: Cases

Cases of tax reduction for social insurance are described below. Two cases are for a main householder and three cases are for a spouse of the householder. A main householder here is a main person in a family who supports living financially. A main householder is often a husband working on full time basis with a work permit type of residential status, and a spouse is a wife with Dependent residential status.

Two Cases for a Main Householder

Tax deduction for a main householder has two cases as follows, depending on enrollment status of social insurance of its employer.

A: A main householder is employed and his or her employer is enrolled in Employee Pension and health insurance union.

- Employer does income tax deduction for social security premium during year end tax adjustment process.

B: A main householder is a business owner, or s/he is employed but his or her employer is NOT enrolled in Employee Pension nor health insurance union, so that the main householder is enrolled individually in National Pension and National Health Insurance.

- Householder does income tax deduction for social security premium as a part of annual tax return process.

Three Cases for a Spouse

Tax deduction for a spouse has three cases as follows, depending on the enrollment status of social insurance at its employer and whether the spouse annual income is lower or higher than threshold amount (1,060,000 or 1,300,000JPY annually)

C: Annual salary of a spouse is less than 1.06 M or 1.30 M JPY

- In this case a spouse is classified as dependent who has no need to pay premium by itself. More specifically, the classification is as follows:

- Pension: National Pension Type 3

- Health Insurance: Dependent

D: Annual salary of a spouse is 1.06 M or 1.30 M JPY or above AND a spouse is enrolled in Employee Pension and health insurance union through its employer.

- In this case a spouse is classified as an insured person and has to pay premium by itself.

- Income tax deduction for social security premium is done by an employer of a spouse.

- More specifically, the classification is as follows:

- Pension: Employee Pension (i.e. National Pension Type 2)

- Health Insurance: Insured person

E: Annual salary of a spouse is 1.06 M or 1.30 M JPY or above BUT his or her employer is NOT enrolled in Employee Pension nor health insurance union, so that the spouse is enrolled individually in National Pension and National Health Insurance.

- In this case a spouse is classified as an insured person and has to pay premium by itself.

- Income tax deduction for social security premium is done by a spouse.

- More specifically, the classification is as follows:

- Pension: National Pension Type 1

- Health Insurance: Insured person

Threshold amount of annual income for a Spouse, either 1.06 M or 1.30 M JPY

In principle, the threshold amount is 1,300 K JPY, as annual income. In case a spouse earns more than the threshold amount, then the spouse is no longer classified as a dependent person but as an independent insured person.

This threshold is lowered down to 1,060 K JPY in case the following criteria are all met. Note that the criteria below have been and will be revised over time so that readers should look for the latest information. More precisely, the size of employees in #5, which is currently “501 or more“, is planned to be revised as “101 or more” in October 2022 and as “51 or more” in October 2024.

Criteria for the threshold amount is lowered down to 1,060 K JPY

A working spouse is a part timer who:

- Works for 20 hours or longer per week.

- Has been or will be employed collectively for one year or longer.

- Earns 88,000 JPY or more as monthly salary.

- Is not a student.

- Satisfies either of the following:

- His or her employer has 501 or more employees.

- His or her employer has 500 or less employees and enrollment with social insurance is agreed between employee and employer and employees.

Tax Deduction – Social Insurance: Alternates for Spouse’s Premium

There are two types to deduct social insurance premium from income for the case E above:

- Deduct from spouse’s income when premium is paid by spouse

- Deduct from main householder’s income when premium is paid by main householder.

As you see below, this second type of the deduction, i.e. deducting from main holder’s income, often leads to larger tax deduction.

How much can you save by social insurance deduction?

Amount of tax deduction can be calculated by the following formula.

- Income Tax = ( Income – Social Insurance Deduction) x Tax Ratio

This formula can be expanded as follows:

- Income Tax = Income x Tax Ratio – Social Insurance Deduction x Tax Ratio

Within the formula above, Social Insurance Deduction x Tax Ratio represents saving of income tax. As amount of Social Insurance Deduction for a particular case is the same and does not change between the two alternatives. On the other hand, Tax Ratio changes, as you see above, depending on amount of income: the higher ratio for a person with the larger income and the lower for a person with the smaller income. This means that saving of income tax is larger for those with larger income thus with higher tax ratio.

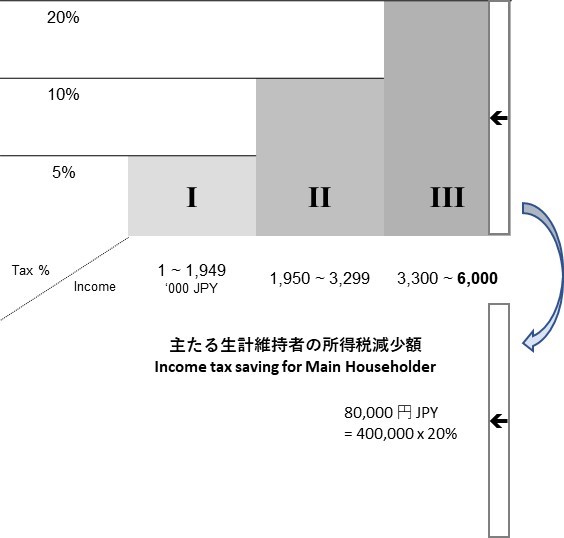

Comparison between the two alternatives – Case study

Let us compare amount of income tax saving between the two alternatives, a and b above, for a sample case. The sample case has the following as amounts of spouse’s social security premium and as income of spouse and main householder.

- Spouse’s social security premium: JPY 400,000 annually, with breakdown of:

- National Pension contribution: JPY 200,000

- National Health Insurance premium: JPY 200,000

- Annual income

- Spouse: JPY 1,800,000

- Main Householder: JPY 6,000,000

Saving of income tax, Social Insurance Deduction x Tax Ratio, are as follows for the alternatives:

- Deduct from spouse’s income

- Social Insurance Deduction x Tax Ratio = JPY 400,000 x 5% = JPY 20,000

- Deduct from main householder’s income

- Social Insurance Deduction x Tax Ratio = JPY 400,000 x 20% = JPY 80,000

In case social insurance premium of spouse are paid by a main householder, saving of tax is greater when the alternative b Deduct from main householder’s income is taken. For the sample case, saving is JPY 60,000 = 80,000 – 20,000.

Tax Deduction – Social Insurance: How to Apply

For an employee, there are two ways as follows to apply for social insurance tax deduction. For a business owner, the second is the only way to do so.

- As a part of Year End Tax Adjustment process at an employer, tax deduction for spouse’s social insurance contribution can be applied.

- When: Typically in November of the current year

- As a part of your own Tax Return process, tax deduction for spouse’s social insurance contribution can be applied.

- When: Typically in January through March of the following year

For applying for the deduction, documents that prove payments of social insurance premium, have to be submitted as attachment. (Such documents include receipts or certificates issued by Japan Pension Service or your local government office operating National Health Insurance).

Tax Deduction – Contacts and References

For details, please contact HR department of your employer over the Year End Tax Adjustment process, and a local national tax office (“ZeimuSho”) or a tax accountant over Tax Return process.

References

- National Tax Office Overview of Income Tax (Japanese)

- National Tax Office Income Tax Ratio (Japanese)

- National Tax Office Social Insurance Deduction (Japanese)

End