Japanese Version

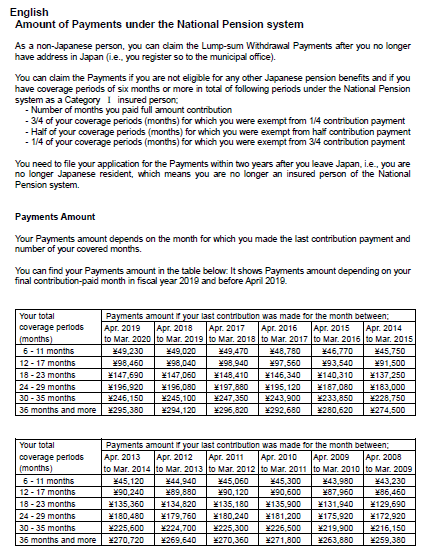

Amount of lump-sum withdrawal from National Pension is defined in the table below. An applicant finds a matching cell in the table to his/her case where the withdrawal amount is indicated. The amounts are designated with the following as principles.

Amount of Lump-sum Withdrawal – National Pension: increases in proportion to “total coverage periods”, i.e. total number of months when premium is contributed in full. The amount does not however increase beyond an upper limit for 3 year “total coverage period”.

Please note the following:

- Only Category I insured person with 6 months or longer as total coverage period is eligible.

- No withdrawal for those with less than 6 months as total coverage period.

- The amount reaches its upper limit for those with 36 months or 3 years as total coverage period, beyond which the amount does not increase any further. (Note that as of Dec 2019 law amendment is under consideration to extend this 3 year upper limit to 5 years. See more details in this blog post.)

- An insured person already eligible for Old-Age Basic Pension can not apply for lump-sum withdrawal. Instead, the person should apply for the old-age basic pension when they reach pension age.

- Coverage month as Category II or III insured person does not count for total coverage period.

- Full amount is paid without withholding tax, unlike Employees Pension.

Definitions of terminologies in the table are as follows.

- Total Coverage Period: Sum of months when premium is paid in full as Category I insured person. Premium waiver periods if any are adjusted to an equivalent period of full premium contribution.

- Your last contribution was made for the months between: A column of the table should be looked up which corresponds to a fiscal year when your last premium contribution is made.

Case study: Withdrawal amount is JPY 196,080, for an insured person with 24 months as Category I and the last premium contributed in January 2019.

End