First of all: This page writes on government subsidies administrated by Ministry of Health, Labor and Welfare (MHLW). The subsidies can be applied by an employer only. Please note that contents in this page are therefore less relevant to those who are interested in subsidies administered by other government offices or who are not an employer.

- Classification of Government Subsidies

- Basics of MHLW Subsidies

- Overview of MHLW Subsidies

- Subsidies with Relaxation of Qualifications for COVID-19

- Employment Adjustment Subsidy – Overview

- Service Fee for Subsidy Application Support

- Contact Us

Classification of Government Subsidies

Government subsidies can be classified by government office who support a subsidy. In Japan, majority of subsidies are administered by the following government offices. Goals of subsidies are of course in line with the ones of an administrative government office.

- Ministry of Health, Labor and Welfare (MHLW): Subsidies for employment and labor conditions

- Ministry of Economy, Trade and Industry (METI): Subsidies for industrial development

- Ministry of Education, Culture, Sports, Science and Technology (MEXT): Subsidies for education and researches

- Municipal governments: Subsidies for local employment and local industrial development

Among these, Anshin Services supports applications for subsidies of MHLW (#1 above).

Basics of MHLW Subsidies

In case you have experience in applying for MHLW subsidies, please skip this “basics” section and move on to the next.

Here are basics of MHLW subsidies.

- Deferred Payment: An employer spends first, and then receives subsidy payment later once approved.

- Qualifications:

- Labor insurance: Enrollment in labor insurance of Japanese government is typically required to be qualified.

- Size of company: For some types of subsidies only a small – medium enterprise (SME) is qualified for application.

- Subsidy Payment:

- Subsidy Ratio: Typically a subsidy does not cover entire expenditure. It does a pre-defined ratio of the expenditure. The ratio is called as “subsidy ratio”, which can be different among subsidies and also between a large enterprise and a small – medium enterprise. For MHWL subsidies, a ratio is usually represented by a common fraction, e.g. 1/2.

- Upper Limit: Total amount of subsidy payment is typically capped by an upper limit. The amount is not unlimited.

Definition of Small-Medium Enterprise (SME) and Large Enterprise (LE)

Please refer to this page for definition of small-medium enterprise and large enterprise.

Overview of MHLW Subsidies

There are quite a few subsidies of many types administered by MHLW. There are long standing subsidies like Employment Adjustment Subsidy, while there are also temporary subsidies lasting for only a year or two, addressing dynamic and temporal needs of a society. MHLW provides a web search tool and a brochure on their subsidies at the following URLs.

- MHLW Search tool to find suitable subsidies (in Japanese)

- MHLW Brochure of subsidies for Year 2020 (in Japanese)

Among the numerous subsidies of MHLW, this page picks up the ones with relaxation of qualification in order to broaden those qualified and ease damage in employment and society from COVID-19 virus infection. This article is written in April 2020. Please allow its contents become obsolete rather quickly as the situation is dynamically changing. I recommend to visit MHLW sites and obtain the latest information when you start working on application for subsidy.

Subsidies with Relaxation of Qualifications for COVID-19

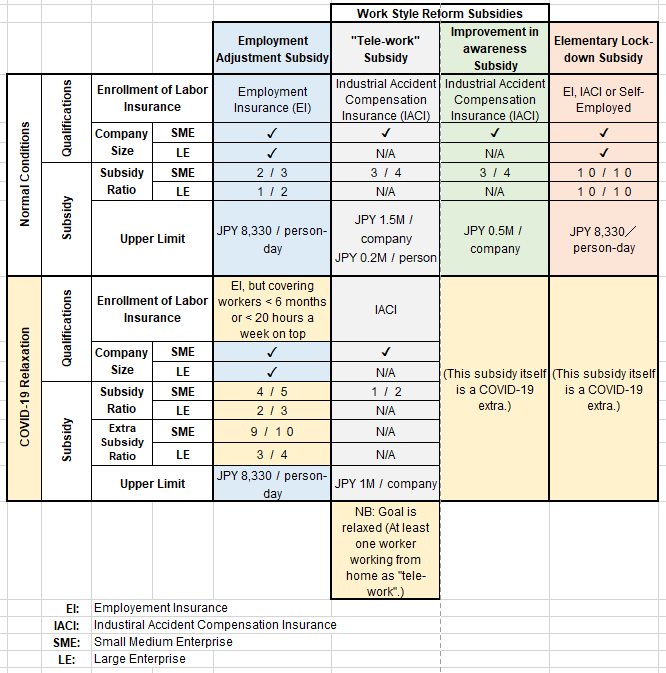

MHLW subsidies with relaxation of qualification for COVID-19 (Corona) virus include the following as of April 2020. (Note that all of the linked MHLW sites are in Japanese).

- Employment Adjustment Subsidy (in Japanese): for leave allowance paid by company to workers on stand by at home.

- Work Style Reform (“Hatarakikata Kaikaku”) Subsidies

- “Tele-work” (or Work-From-Home) subsidy (in Japanese): for cost of introduction of “tele-work” style.

- Improvement in awareness subsidy (in Japanese): for cost of introduction of special paid leave for COVID-19.

- Elementary School Lock-Down Subsidy(in Japanese): for wage paid to allow parents to take special paid leave to take care of children staying at home due to COVID-19 elementary school lock-down.

Qualifications, subsidy payments and relaxation off these four are summarized below. Details can be found at MHLW sites at the links above (though all are in Japanese). There is an interesting article in policy perspectives on these COVID-19 relaxation posted by Mr. Hamaguchi, Head of Research, Japan Institute for Labor Policy and Training at the link below.

- Japan Institute for Labor Policy and Training: COVID-19 and Labor Policies in the future (in Japanese)

Employment Adjustment Subsidy – Overview

Among these subsides, Employment Adjustment Subsidy (EAS) is a mainstream. Details of EAS, qualifications, payment conditions and procedures, can be found in this page, which covers both regular EAS and special EAS for COVID-19 by comparing differences between the two.

Service Fee for Subsidy Application Support

Service fee for subsidy application support is as follows. Prices are all excluding consumption tax of 10%: the tax is separately added on top.

- Initial consultation: Free of charge for 30 minutes

- Base Fee: JPY 50,000, which will be reimbursed from Contingent Fee

- Contingent Fee: 10% of subsidy amount paid minus Base Fee or JPY 50,000, whichever is higher

- Others

- Potential extra fee will be quoted for support in meeting prerequisites for application, e.g. Rules of Employment.

- Expenses: Actual expenses for transportation, postal and fees payable to government offices.