Amount of your public pension of Japan, to be paid in the future, can be estimated using a feature within Nenkin-net online service offered by Japan Pension Service (JPS). The feature allows to calculate an estimated amount, however, only under a typical scenario for a Japanese national, i.e. assuming that you continue to contribute at the same level with the current contribution until pension age of 65.

The feature does not provide an estimation in different but likely scenarios for a world talent in Japan. Such scenarios include a case where a world talent is relocated to other countries after having contributed to Japan public pension for 10 years or longer and become eligible to receive Japan pension later in life.

This article explains how to calculate approximately pension amount under the likely scenarios for a world talent in Japan. If you are in a hurry, read only the first section, “Quick Summary” and calculate appropriate amount of your pension. If you have time and are interested in details, read the rest.

- Quick Summary

- Why Approximation

- Three Tier Pension Scheme in Japan

- Tier 1- National Pension: Approximate Amount of Old Age Basic Pension

- Tier 2 – Employee Pension: Approximate Amount of Old Age Welfare Pension

- Total Pension Amount for a Household

- Note

- Contact Us for More Details

Quick Summary

- Tier 1- National Pension: Approximate Annual Amount of Old Age Basic Pension

- = JPY 781,700 x Years of Contribution / 40 years

- Tier 2 – Employee Pension: Approximate Annual Amount of Old Age Welfare Pension

- = Annual Compensation x 0.95 x 5.481 x Years of Contribution / 1000 + Tier 1 Amount

- Note: “Annual Compensation” is annual total of your monthly salary and bonus. If your monthly salary is greater than JPY 650,000 OR if your one-time bonus (not annual total bonus) is greater than JPY 1,500,000, then you have to adjust “Annual Compensation” in the formula above. See “Tier 2 – Employee Pension: Approximate Annual Amount of Old Age Welfare Pension” for details on the adjustment.

Why Approximation?

There are a number of reasons why approximation is required and why not calculating exact amounts. The reasons include the following:

- Amount of pension is adjusted every year to be in line with rate of inflation (e.g. CPI) and average wage increase across Japan. In other words, pension amount catches up with inflation in order not to be too depreciated. This means that a future amount can not be predicted completely. It is an estimation by nature.

- Amount of Employee (welfare) Pension depends on your amount of salary and bonus throughout your enrollment period. Salary and bonus in the past are fixed and can be calculated exactly. The ones in the future are not yet fixed thus can not be calculated exactly. Therefore assumption of future salary and bonus is required to estimate pension amount, that is by nature an approximation.

Three Tier Pension Scheme in Japan

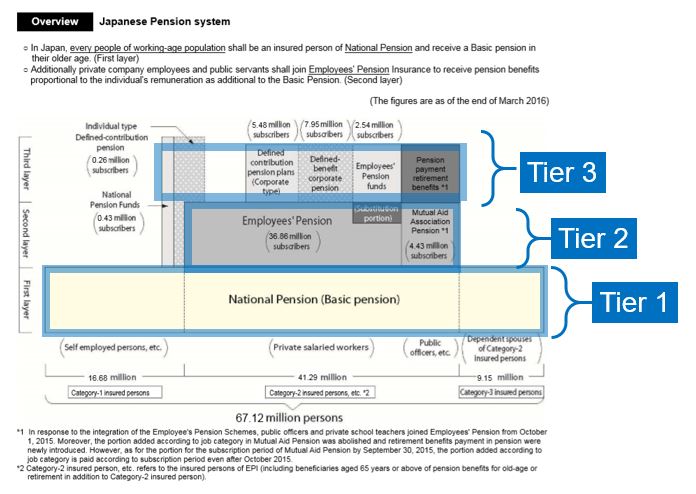

Pension scheme in Japan is layered in three tiers as in the diagram below. This article covers the first two public pensions but does not do so the top Tier 3, because the Tier 3 is not mandatory and different among systems within.

- Tier 1: public National Pension system

- Tier 2: public Employee Pension system

- Tier 3: private Defined Benefits / Defined Contribution systems

It should be noted that enrollment with Tier 1, National Pension, is mandatory for all residents in Japan at age between 20 and 60 regardless of nationality. So that an employee participating Tier 2, Employee Pension, has to enroll Tier 1 as well in general, which is in fact automatically arranged by JPS.

Amount of public pension for those enrolled inTier 2 is therefore a sum of amounts of Tier 1 and 2.

Tier 1- National Pension: Approximate Amount of Old Age Basic Pension

The first tier, National Pension system, pays Old Age Basic Pension to those who are eligible typically at age of 65 or older. Pension amount can be calculated as follows.

Annual Pension Amount = Full Pension Amount x Months of Contribution / ( 40 years x 12 months )

where:

- Full Pension Amount is adjusted yearly basis. The latest amount is JPY 781,700 (as of Jan 2021).

- Months of Contribution is a number of months when you are enrolled and also actually pay your contribution. Months when you are enrolled but do not pay contribution are not counted. In case there are months when contribution is formally exempted fully or partially, such months of exemption are added to the months of contribution on a pro-rata basis. Should you be interested in this pro-rata calculation, please contact us for details.

Case study 1-1: for 10 year enrollment and contribution, the amount of Old Age Basic Pension is estimated as JPY 195,425 = 781,700 x 10 years x 12 months / (40 years x 12 months).

Case study 1-2: for 15 year enrollment and contribution, the amount of Old Age Basic Pension is estimated as JPY 293,138 = 781,700 x 15 years x 12 months / (40 years x 12 months).

Tier 2 – Employee Pension: Approximate Amount of Old Age Welfare Pension

The second tier, Employee Pension system, pays Old Age Welfare Pension to those who are eligible typically at age of 65 or older.

Calculating amount of Employee Pension is more complicated than National Pension, because the amount depends not only on how long you enroll and contribute but also on how much you contribute. The latter, amount of contribution, is different among employees, because it is proportional to amount of salary and bonus. So that amount of Old Age Welfare Pension is different among employees and has to be calculated individually.

Annual Pension Amount = Monthly Average of Normalized Standard Salary and Bonus Amounts x 5.481 x Months of Contribution / 1000

where:

- Monthly Average of Normalized Standard Salary and Bonus Amounts is calculated as Σ(Normalization Factor x Standardization of (Actual Salary or Actual Bonus) ) / Months of Contribution.

- where:

- Normalization Factor is revised every year that is applicable to salary and bonus paid for that year.

- Standardization is essentially to round up or down to the nearest “standard” amount of salary or bonus.

- Months of Contribution is length of contribution period in terms of number of months.

- Parameter: Value of 5.481 is used for salary and bonus paid in April 2003 or later for a person born on April 2nd, 1946 or later. This range should cover cases of intended readers of this article. Different values are used for salary and bonus not within the time and age ranges above. Should you be interested in the other parameter values, please contact Anshin Services.

This calculation is rather cumbersome, if not impossible, so that the following simpler formula is provided by Anshin Services for approximation.

Approximation of Annual Pension Amount = Average of Adjusted Total Annual Compensation x 0.95 x 5.481 x Years of Contribution / 1000

where:

- Average of Adjusted Total Annual Compensation is your average total annual compensation including only salary and bonus throughout your contribution period. Note that salary and bonus are adjusted as follows when this is calculated.

- If your monthly salary is JPY 650,000 or less AND your one-time (not annual total) bonus is JPY 1,500,000 or less, then no adjustment is required, use your actual or estimated annual compensation as “adjusted” in the calculation above.

- If your monthly salary is greater than JPY 650,000, then use JPY 650,000 as your adjusted monthly salary when you calculate annual compensation.

- If your one-time bonus (not annual total bonus) is greater than JPY 1,500,000, then use JPY 1,5000,000 as your adjusted bonus when you calculate annual compensation.

- Normalization parameter: is fixed to 0.95 in this approximation formula. This should meet the purpose as normalization parameters are set between 0.93 and 0.98 depending on year when salary or bonus is paid.

Case study 2-1: for 10 year enrollment and contribution by an insured person with JPY 6 M average annual compensation during the 10 year period, with JPY 400 K monthly salary and JPY 600 K bonus paid twice a year thus no adjustment made, then approx. annual pension amount of Old Age Welfare Pension is estimated as JPY 312,417 = JPY 6,000,000 x 0.95 x 5.481 x 10 years / 1,000.

(Case study 2-1: continued) Therefore total amount of public pension for a person enrolled with Tier 2 Employee Pension is sum of Old Age Basic Pension (Tier 1) as calculated in Case Study 1-1 above, and Old Age Welfare Pension (Tier 2), which is estimated approximately as JPY 507,842 = 195,425 + 312,417.

Case study 2-2: for 15 year enrollment and contribution by an insured person with JPY 12.4 M average annual compensation during the 15 year period, with JPY 700 K monthly salary and JPY 2 M bonus paid twice a year, both in average, which are adjusted as JPY 650 K and JPY 1.5 M respectively leading to JPY 10,800 K (= 650 x 12 + 1,500 x 2) adjusted annual compensation, then the approx. annual pension amount of Old Age Welfare Pension is estimated as JPY 843,526 = JPY 10,800,000 x 0.95 x 5.481 x 15 years / 1,000.

(Case study 2-2: continued) Therefore total amount of public pension for a person enrolled with Tier 2 Employee Pension is sum of Old Age Basic Pension (Tier 1) as calculated in Case Study 1-2 above, and Old Age Welfare Pension (Tier 2), which is estimated approximately as JPY 1,136,664 = 293,138 + 843,526.

Total Pension Amount for a Household

In case you have a spouse during your stay in Japan, your spouse is also enrolled in Japan’s public pension. So that you may want to add up pension amount for your spouse when you want to calculate pension amount for a household.

Amount of Pension for a Household = Your Amount + Your Spouse’s Amount

Depending on spouse’s employment status, pension enrollment is typically as follows. Depending on a case applicable to your spouse, amount of spouse’s pension is either a sum of Tier 1 and Tier 2 or Tier 1 only.

- If your spouse is a full time employee:

- It is likely that your spouse is enrolled in both Tier 1 and 2, National and Employee Pensions through your spouse’s employer.

- So that pension amount for your spouse can be also calculated as in the section above for Tier 1 and 2.

- If your spouse is a part time employee and earns 1.06 or 1.30 M JPY a year or more, there are two scenarios possible as follows. Find out which is applicable and calculate pension amount for your spouse accordingly.

- Enrolled in both Tier 1 and 2 through your spouse’s employer, then calculate amount as in the section above for Tier 1 and 2.

- Enrolled only in Tier 1 through contributions by herself / himself, then calculate amount as in the section above only for Tier 1.

- If your spouse is a part time employee and earns less than 1.06 or 1.30 M JPY a year or if your spouse does not work:

- Your spouse is enrolled only in Tier 1, not directly but indirectly as a spouse of yourself, then calculate amount as in the section above only for Tier 1.

- Note that this last case, classified as National Pension Type 3, is often overlooked because there is no direct contribution paid by your spouse. The contribution is paid indirectly through your contribution for Tier 2, Employee Pension. In spite of no direct contribution, your spouse is entitled to receive Tier 1 pension amount if enrolled for 10 years or longer.

Note: The threshold annual salary amount, 1.06 or 1.30 M JPY a year, between #2 and #3 depends on terms in employment contract and also on size of an employer of your spouse. See “Threshold amount of annual income for a Spouse, either 1.06 M or 1.30 M JPY” topic within another article of this site for details.

Note

- Public pensions are for life long, being paid until a pension recipient deceases.

- There are cases where Survivors Basic and/or Welfare Pension is paid to qualified survivors after decease of insured person or pension recipient.

- Typical case is for a spouse and a child (younger than 18 year old), who are dependent on an insured when an insured person decreases.

- Amounts:

- Survivors Basic Pension: Approximately JPY 1 M is paid annually until a child becomes 18 year old.

- Survivors Welfare Pension: Three fourth (3/4) of the amount of Old Age Welfare Pension is paid to a spouse for life long.

- Pension can be received regardless of residence address of a recipient: who can receive even if s/he is relocated out of Japan.

End