Japanese Version

Japan has tied social security agreement with 20 countries as of September 2019. The agreement has objectives as follows:

- To avoid duplicated enrollments and premium contributions at the same time for pensions in Japan and home country.

- To “totalize” pension coverage periods of two countries, i.e. summing up the periods of two countries when pension eligibility is reviewed in terms of the coverage period, so that having pension coverage periods split into two countries would not be disadvantage.

The countries in the table below have (or will have) social security agreement with Japan are listed in the table below. Note that agreements with some of the countries do not include the totalization while all of the countries have the avoidance duplicated enrollments agreed with Japan.

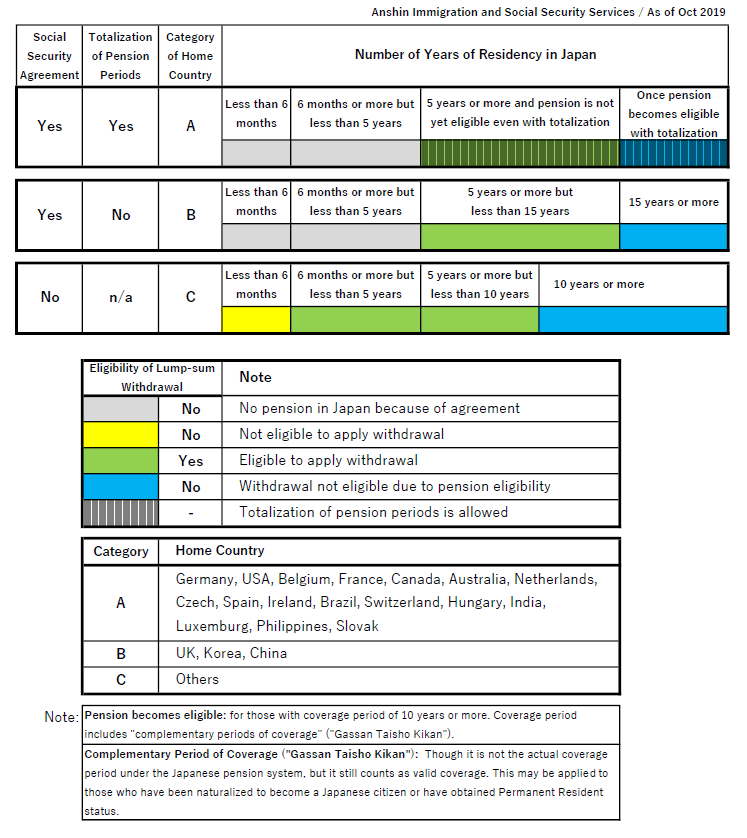

List-of-Social-Security-Agreements-E-v3Relationship between social security agreement and lump-sum withdrawal can be summarized as in the table below. Colors in the table indicate withdrawal eligibility:

- Green: An insured non-Japanese person falling into a green cell can apply for withdrawal.

- Gray: No withdrawal is expected for those, who live in Japan for less than 5 years and come from a country, which has the social security agreement tied with Japan.

- Yellow / Blue: No withdrawal is allowed for those with coverage period either of less than 6 months (yellow) OR of 10 years or longer (blue).

End